Iluminação personalizada para seu projeto

Oferecer soluções inovadoras, confiáveis e sustentáveis no fornecimento de produtos para iluminação e instalações elétricas, com alto nível de desempenho para desenvolvimento das áreas industriais, públicas e corporativas.

Por que escolher a Wiko?

Utilizamos matéria prima certificada, tecnologia de revestimento e proteção comprovadamente eficazes, resultando desta forma em produtos de excelente qualidade e durabilidade para que nossos clientes estejam sempre satisfeitos.

Refletor Cob 10w

FLUXO LUMINOSO: 550lm ÂNGULO DE ABERTURA: 120º POTÊNCIA: 10W FREQUÊNCIA: 50/60 Hz FATOR DE POTÊNCIA: > 0.5 TEMP. DE OPERAÇÃO: -20QC A 50QC ÍNDICE DE PROTEÇÃO: IP 65 CÓDIGO DE BARRAS: 7898622821454/ 7898622821454/ 7898622821478/ 7898622821478/ 7898622821492/ 7898622821508/ TEMPERATURA DE COR: BRANCA FRIA/BRANCA QUENTE/ VERDE/VERMELHA/AZUL/RGB/

Refletor Cob 30w

FLUXO LUMINOSO: 1650lm ÂNGULO DE ABERTURA: 120º POTÊNCIA: 30W FREQUÊNCIA: 50/60 Hz FATOR DE POTÊNCIA: > 0.5 TEMP. DE OPERAÇÃO: -20QC A 50QC ÍNDICE DE PROTEÇÃO: IP 65 CÓDIGO DE BARRAS: 7898622821515/ 7898622821522/ 789862 2821522/78986 2 28 215 22/ 78986 2 2821553/78986 2 28215 60/ TEMPERATURA DE COR: BRANCA FRIA/BRANCA QUENTE/ VERDE/VERMELHA/AZUL/RGB/

Refletor Cob 50w

FLUXO LUMINOSO: 2750lm ÂNGULO DE ABERTURA: 120º POTÊNCIA: 50W FREQUÊNCIA: 50/60 Hz FATOR DE POTÊNCIA: > 0.5 TEMP. DE OPERAÇÃO: -20QC A 50QC ÍNDICE DE PROTEÇÃO: IP 65 CÓDIGO DE BARRAS: 7898622821577 / 7898622821577 / 7898622821591/ 7898622821607 / 7898622821614/ 7898622821621/ TEMPERATURA DE COR: BRANCA FRIA/BRANCA QUENTE/ VERDE/VERMELHA/AZUL/RGB/

Refletor Cob 100w

FLUXO LUMINOSO: 5550lm ÂNGULO DE ABERTURA: 120º POTÊNCIA: 100W FREQUÊNCIA: 50/60 Hz FATOR DE POTÊNCIA: > 0.5 TEMP. DE OPERAÇÃO: -20QC A 50QC ÍNDICE DE PROTEÇÃO: IP 65 CÓDIGO DE BARRAS: 7898622821638/ 7898622821645/ 7898622821652/ 7898622821669/ 7898622821676/ 7898622821683/ TEMPERATURA DE COR: BRANCA FRIA/BRANCA QUENTE/ VERDE/VERMELHA/AZUL/RGB/ DIMENSÕES 285*345*89

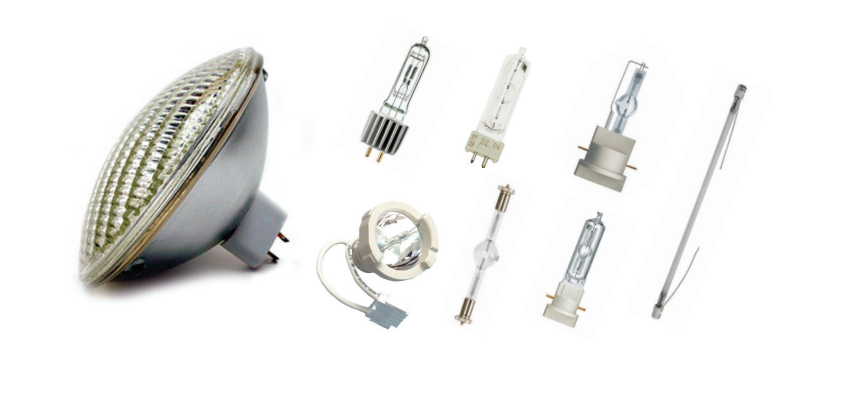

Lâmpadas Especiais

Lâmpadas especiais para todos os tipos de eventos: shows, teatros, televisão, estúdios e festas em geral CÓDIGO POTÊNCIA FLUXO IRC TEMPERATURA VIDA EFICIÊNCIA DIMENSÃO TENSÃO BASE null (WATTS) LUMINOSO null DE COR MEDIANA LUMINOSA (h X mm) MINIMA P/ null null null (Lm) null (ºK) (h) (Lm/W) null IGNIÇÃO (v) null MSR 400 400 32.000 92 5.900 ºK 1.000h 80 23x112 207 GX9,5 MSR 575/2 575 49.000 80 7.200 ºK 1.000h 85 30X125 207 GX9,5 MSR 700 700 55.000 80 5,900 ºK 1.000h 80 30X155 207 G22 MSR 700/2 700 55.000 80 7.200 ºK 1.000h 71 30X155 207 G22 MSR 1200 1.200 1.100.000 95 5.900 ºK 800h 91 40X175 207 G22/30X53 MSR 1200/2 1.200 1.100.00 95 7.200 ºK 800h 91 40X175 207 G22/30X53 MSR 125 HR 125 94.000 92 6.000 ºK 200h 75 17X75 207 GZX9,5 MSR 200 HR 200 15.000 92 6.000 ºK 200h 75 20X80 207 GZX9,5 MSR 400 HR 400 32.000 92 6.000 ºK 750h 80 23X110 207 GZZ9,5 MSR 575 HR 575 49.000 95 6.000 ºK 1.000h 85 30X145 207 G22 MSR 1200 HR 1.200 110.000 95 6.000 ºK 1.000h 91 40X200 207 G38 MSR 2500 HR 2.500 240.000 95 6.000 ºK 500h 96 60X240 207 G38 MSR 4000 HR 4.000 380.000 95 6.000 ºK 500h 95 77X255 207 G38 MSR 6000 HR 6.000 570.000 95 6.000 ºK 500h 95 74X378 207 GY38 MSR 12000 HR 12.000 1.200.000 95 6.000 ºK 300h 100 103X460 207 GY38 CÓDIGO POTÊNCIA FLUXO IRC TEMPERATURA VIDA EFICIÊNCIA DIMENSÃO TENSÃO MINIMA VOLTAGEM BASE null (WATTS) LUMINOSO (Lm) null DE COR (ºK) MEDIANA (h) LUMINOSA (Lm/W) (h X mm) P/ IGNIÇÃO (v) (v) null MSD 200 200 13.500 80 6.000 ºK 2.000h 67 23X108 207 70 GX9,5 MSD 250/2 250 18.000 65 8.500 ºK 3.000h 72 23X108 207 94 GY9,5 MSD 575 575 43.000 75 6.000 ºK 3.000h 86 30X125 207 95 GX9,5 MSD 700 700 50.500 75 6.000 ºK 3.000h 72 40X175 207 72 G22 MSD 1200 1.200 92.000 80 6.000 ºK 3.000h 77 41X183 207 100 G22

Jbl-b5

CÓDIGO POTÊNCIA TEMPERATURA FOCO DIMENSÃO TENSÃO MINIMA P/ VOLTAGEM BASE null (WATTS) DE COR (ºK) null (h X mm) IGNIÇÃO (v) (v) null PAR 64 1.000 3.200 ºK Foco 1 17x20 207 127/220 GX16d PAR 64 1.000 3.200 ºK Foco 2 17x108 207 127/220 GX16d PAR 64 1.000 3.200 ºK Foco 3 17x125 207 127/220 GX16d CÓDIGO POTÊNCIA TEMPERATURA FOCO DIMENSÃO TENSÃO MINIMA P/ VOLTAGEM BASE null (WATTS) DE COR (ºK) null (h X mm) IGNIÇÃO (v) (v) null PAR 64 1.000 3.200 ºK Foco 1 17x20 207 127/220 GX16d PAR 64 1.000 3.200 ºK Foco 2 17x108 207 127/220 GX16d PAR 64 1.000 3.200 ºK Foco 3 17x125 207 127/220 GX16d

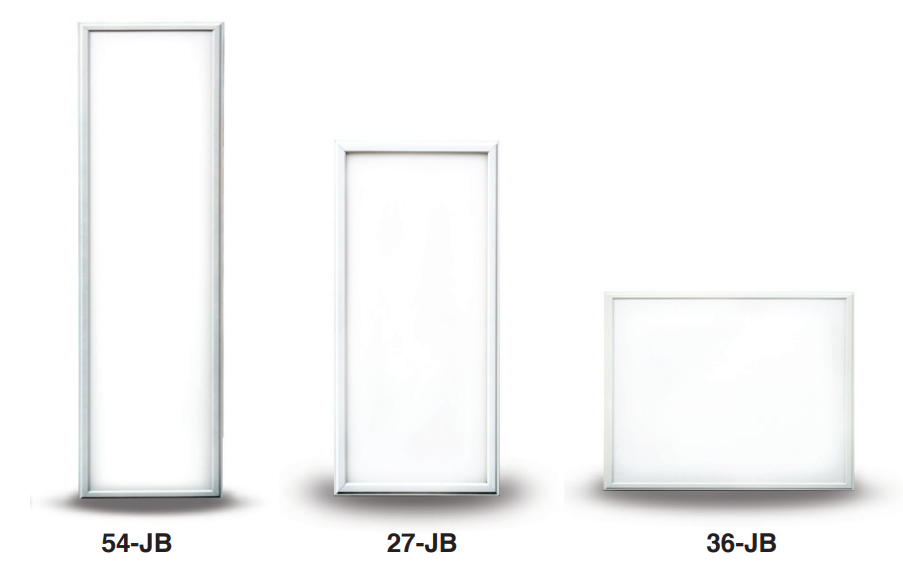

Plafon De Embutir Wiko

CÓDIGO POTÊNCIA (WATTS) IRC TEMPERATURA DE COR (ºK) EFICIÊNCIA LUMINOSA (Lm) DIMENSÃO (mm) FACHO 27F-JB 27 70 6000 ºK ~ 6500 ºK 2200 300x618x11 120 27N-JB 27 70 4000 ºK ~ 4500 ºK 2100 300x618x11 120 27Q-JB 27 70 3000 ºK ~ 3200 ºK 2050 300x618x11 120 36F-JB 54 70 6000 ºK ~ 6500 ºK 4000 618x618x11 120 36N-JB 54 70 4000 ºK ~ 4500 ºK 3800 618x618x11 120 36Q-JB 54 70 3000 ºK ~ 3200 ºK 3720 618x618x11 120 54F-JB 54 70 6000 ºK ~ 6500 ºK 4000 300x1200x11 120 54N-JB 54 70 4000 ºK ~ 4500 ºK 3800 300x1200x11 120 54Q-JB 54 70 3000 ºK ~ 3200 ºK 3720 300x1200x11 120

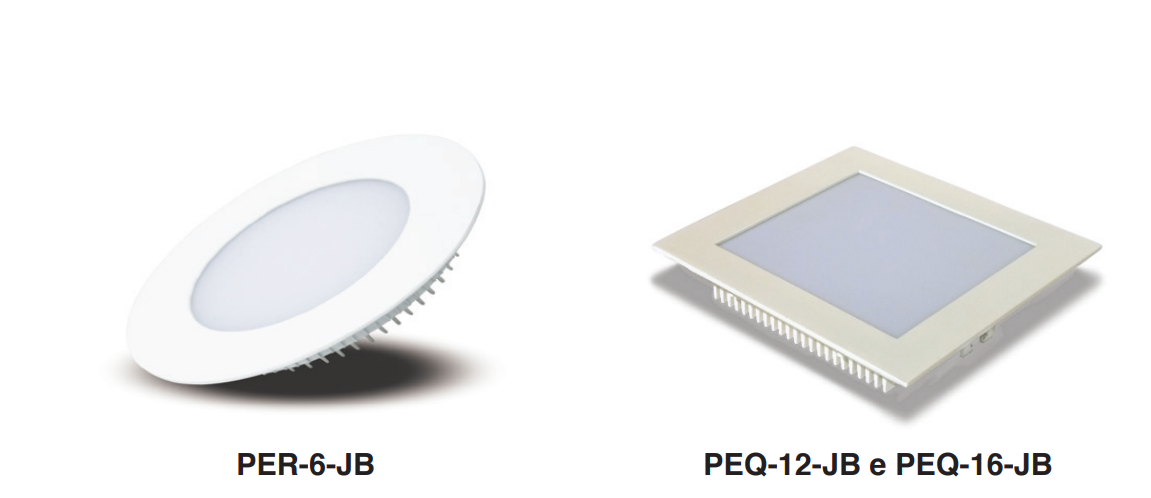

Plafon De Embutir

CÓDIGO POTÊNCIA (WATTS) IRC TEMPERATURA DE COR (ºK) EFICIÊNCIA LUMINOSA (Lm/W) DIMENSÃO (mm) DIMENSÃO P/ EMBUTIR (mm) PER-6F-JB 6 70 5000 ºK 450 Ø 108X40 Ø 98 PER-6Q-JB 6 70 2700 ºK 430 Ø 108X40 Ø 98 PEQ-12F-JB 12 70 5000 ºK 900 155x155x30 135x135 PEQ-12Q-JB 12 70 2700 ºK 860 155x155x30 135x135 PEQ-16F-JB 12 70 5000 ºK 1200 155x155x30 160X160 PEQ-16Q-JB 16 70 2700 ºK 1140 180x180x30 160X160

Dicróicas Led Gu10

CÓDIGO POTÊNCIA (WATTS) FLUXO LUMINOSO (Lm) FACHO TEMPERATURA DE COR (ºK) RA COMPRIMENTO (m) BASE GU10-JBD-5F 4 320 120 ° 6.000 ºK >70 50X56mm GU10 GU10-JBD-5Q 4 300 120 ° 3.000 ºK >70 50X56mm GU10 GU10-JBD-5BF 5 350 30 ° 6.000 ºK >70 50x68mm GU10 GU10-JBD-5BQ 5 350 30 ° 3.000 ºK >70 50X56mm GU10 GU10-JBD-4BF 4 230 30 ° 5.500 ºK >70 50x60mm GU10 GU10-JBD-4BN 4 220 30 ° 4.000 ºK >70 50x60mm GU10 GU10-JBD-4BQ 4 215 30 ° 2.700 ºK >70 50x60mm GU10

Vela

CÓDIGO POTÊNCIA (WATTS) FLUXO LUMINOSO (Lm) FACHO TEMPERATURA DE COR (ºK) RA COMPRIMENTO (m) BASE VELA-JBV-3AF 4 300 300 ° 5.5000 ºK >70 37X124mm E-14 VELA-JBV-3AQ 4 280 300 ° 2.800 ºK >70 37X124mm E-14 VELA-JBV-3BF 5 300 300 ° 5.5000 ºK >70 37X124mm E-27 VELA-JBV-3BQ 5 280 300 ° 2.800 ºK >70 37X124mm E-27 VELA-JBV-2AF 4 300 300 ° 6.000 ºK >70 37X125mm E-14 VELA-JBV-2AQ 4 280 300 ° 3.000 ºK >70 37X125mm E-14

Bulbo Led

CÓDIGO POTÊNCIA (WATTS) FLUXO LUMINOSO (Lm) FACHO TEMPERATURA DE COR (ºK) RA COMPRIMENTO (m) BASE JBL-B5F 5 400 180 ° 6.000 ºK >73 50X94mm E-27 JBL-B5Q 5 400 180 ° 3.000 ºK >73 50X94mm E-27 JBL-B9F 9 880 180 ° 6.000 ºK >70 58x103mm E-27 JBL-B9Q 9 880 180 ° 3.000 ºK >70 58x103mm E-27 JBL-B9AF 9 850 180 ° 6.000 ºK >70 60x110mm E-27 JBL-B9AN 9 810 180 ° 3.000 ºK >70 60x110mm E-27 JBL-B9AQ 9 790 180 ° 2.800 ºK >70 60x110mm E-27 JBL-B12F 12 1.000 300 ° 6.000 ºK >70 95x150mm E-27 JBL-B12Q 12 930 300 ° 3.000 ºK >70 95x150mm E-27

Solicite um Orçamento Agora

Deixe seu contato e receba nossas novidades

O que procura?

Assine nosso newsletter